In order to properly look at your business’s financial standing, it is crucial to understand the difference between cash flow and profit. The relationship between cash flow and profit is one that needs to be understood in order to manage your business finances effectively.

So many people ask: I am showing a profit, why don’t I have any money?

One reason this happens is that you record some credit card expenses and those hit the P&L where your Profit is showing, but then maybe you make big payments on that credit card the following month which will affect the cash flow and the balance sheet. The same is true for loan payments. This has even more of an impact because the loan money only shows on your balance sheet, not your Profit and loss. If you take money out of your business that is a draw. It is recorded on the equity portion of your balance sheet. It is not already subtracted from your net income on your profit and loss. Other examples of cash being paid out but not immediately affecting your profit could be when insurance premiums are made, payments made to increase a current asset, and payments are made to reduce liabilities.

Bookkeepers are often asked this question and their starting point will almost always be to look over the balance sheet and see where the money has gone.

Terms

Cash Flow:

Cash Flow is money that is constantly moving in and out of the business. The cycle of your cash flow can change depending on how many expenses your business has that month vs how many payments were received.

Cash flow can be either positive or negative. If a business has positive cash flow that means that there is more money coming in than going out. If a business has a negative cash flow that means that there is less money coming in than going out. The business’s cash flow can also change throughout the month from positive to negative.

Profit:

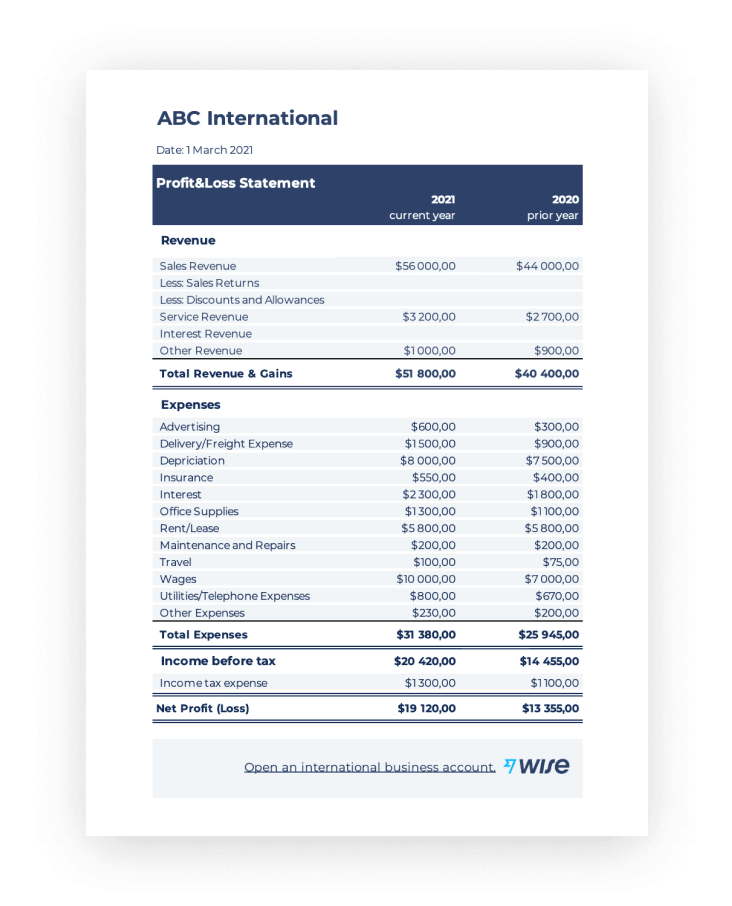

The profit of a business is the amount left over after all expenses have been subtracted. This amount is typically either paid out or reinvested into the business. There are two types of profits found on your income statement and they are “Gross Profit” and “Net Profit”.

Gross Profit is the amount of income your business has made.

Net Profit is the amount of income your business has made (Gross Profit) minus any operating expenses.

Profit and Loss:

The profit and loss (P&L) will show you what your business bottom line is over a period of time. It shows what revenue, costs, and expenses your business had over the selected time frame.

Balance Sheet:

The balance sheet shows the summary of your business’s financial balances over a selected period of time. More specifically, it will show the balances in both your asset and liability accounts.

Which is More Important?

Profit is most important when you are looking at your business’s overall success. It shows you how successful your business is. Cash flow is more important when you are looking at your day-to-day operations. It shows you the amount of money you have coming into your business and the amount going out and can help ensure you have enough to pay your bills.

For more financial terminology please read my blog post “Why Financial Literacy is Important in Small Business”